Yearn.Finance is one of the essential DeFi projects. This project aims to provide easy access to yield farming and various liquidity mining strategies. Many investors are looking to find a way to improve the operation of yield agriculture on the Ethereum network. Yearn is a platform just for investors, so if you are looking to increase the profitability of your investment, you should learn more about the yearn protocol.

To put it simply, yearn, the protocol uses smart contracts to exchange assets and value between liquidity pools. In this case, the investor will benefit from more profit. Stay tuned to understand everything about this protocol and the great solution. Looking for the best possible profit at all time, you should learn how does Year Finance work? And why do you need to take part in it?

The history of Yearn.Finance

Andrew Cronje created Yearn.Finance following the idea of designing an easy-to-use DeFi platform that will increase the profit investor earns from yield farming.

He is one of the well-known crypto figures for his knowledge in mobile development. He created Yearn protocol in January 2020. Since then, it has become one of the 10 DeFi platforms globally in terms of magnitude.

Why was Yearn.Finance produced?

Andrew Cronje created a group protocol for yield farming; it is right to say that this platform is a decentralized bot for yield farming.

The DeFi projects have become very popular, but most people are excluded from the finance. Because being a successful investor in the DeFi industry depends largely on your strategic investment. How will you choose the best pool when you do not have access to reliable information?

Yearn.Finance is a group of protocols based on several smart contracts that provide the investor with the best strategy. And the most important thing about the whole process is that the entire process works without intermediaries’ intervention.

What is Yearn.Finance?

To put it simply, Yearn.Finance is a group of protocols designed to run on the Ethereum blockchain. Yearn aims to optimize investors’ earnings on crypto assets.

Using this decentralized finance project, users do not need to seek help from intermediaries like financial custodians and banks. This DeFi project provides lending and borrowing aggregation, insurance, and yield generation.

After spending years grasping blockchain and cryptocurrencies in different companies, Andrew Cronje created this project. Then he became a great advisor, consultant, engineer, and analyst for various crypto-related companies. When you start to use a yearn project, you will encounter different options, which we intend to explain more in the following.

Components of Yearn.Finance platform

Yearn is a portal for a series of DeFi products. There are different options on the Yearn.Finance website. Here we will explain them in detail.

Vaults

Vaults are investing tools that generate yield by using capital pools. These tools are designed to create the highest return from DeFi projects. Users just love this product. Some even call it a Robo-advisor for yield.

Users that enter pools are not experts in trading or do not have enough time to monitor the market, so they join pools to generate returns.

So vaults are great for minimizing risk and earning yield. Yearn is your consultant; just like its founder, it will use the deposited asset to borrow stablecoins then use them for yield farming opportunities.

As soon as the vault realizes gains, it will convert them back to the deposited asset.

Earn

This product tries to find the highest interest rate a user can enjoy lending an asset. It is a lending aggregator looking for the best interest rate on the market.

Here you can deposit one of the following stablecoins to earn interest: TUSD, sUSD, USDT, USDC, DAI, and wBTC. Earn will search for a DeFi project that will earn you more profit.

Zap

You can swap between different pools and handle different trades at once using this tool. Zap is an access point to Zapper.fi, a DeFi routing service, and aggregator.

This tool enables you to engage with more DeFi projects and products. For instance, if you want to hold onto your Ethereum, you need to deposit your ETH and convert them into YFI, the governance token of Yearn project. In this process, you need to deposit YFI.; you have to spend more time and pay more gas fees to enter a pool. But when using Zap, these steps will be bundled into one process.

APR / APY

This table of information lets you see different interest rates across different lending pools. Here you can simply monitor different products and their interest rates.

APY is short for annual percentage yield, demonstrating different interest rates across lending pools. In that sense, the user will estimate how much interest he might earn by investing in different pools.

Yearn has other products as well that are currently being tested.

How does Yearn.Finance work?

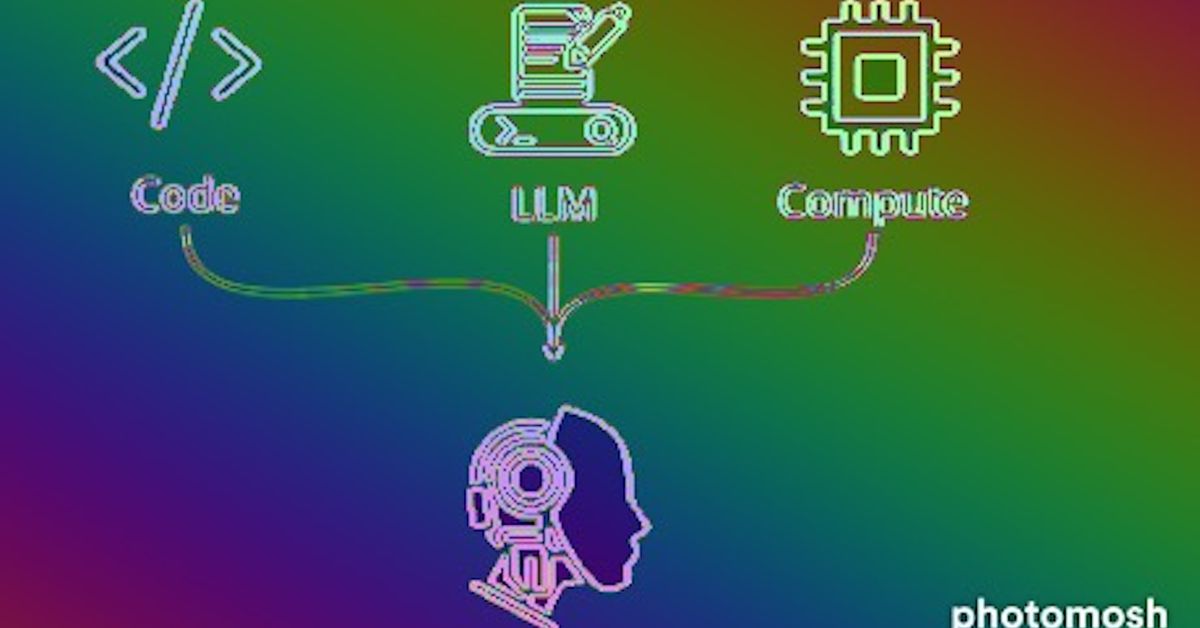

Yearn is a group of protocols that aims to place intelligent contracts between the Ethereum blockchain and decentralized exchanges running on it.

All Yearn products try to let users lend or trade their tokens.

For instance, by using earn, you will find the best interest rate on lending. You can search through different lending pools to find the best deal.

Then you can deposit stablecoins on the Yearn platform and receive those interest rates.

Using APR will find the most profitable pools on the DeFi projects. Then Vaults tool or the Robo- advisor of yield will manage your investment strategy.

On the other hand, Zap lets you make several investments in a single click and pay less transaction fee. This tool is time-saving.

The YFI token.

YFI is the governance token of the Yearn platform. There are 30000 YFI tokens total. YFI owners can vote on the regulations. The fee for vaults service is 5%, and for vaults and Eran is 0.5%. The prices will make the total revenue of the platform, then YFI owners will receive a share. $500000 of the fee will remain, and the rest will be distributed among YFI holders.