Uniswap is one of the most talked-about decentralized crypto exchanges in 2021. This decentralized cryptocurrency exchange allows for ERC20 swaps. UNI is the native and governance token of this exchange.

Despite the essential nature of cryptocurrency, most crypto trading takes place on centralized exchanges worldwide. In these types of exchanges, users need to place assets under the control of a central authority. To solve the problem, a developer created Uniswap. Before buying UNI from local exchange, read this article to find everything about this decentralized crypto exchange.

What Is Uniswap?

Uniswap is a decentralized currency exchange that is not owned or operated by a single authority. The exchange uses a new type of trading model called an automated liquidity protocol, which we will discuss in detail later.

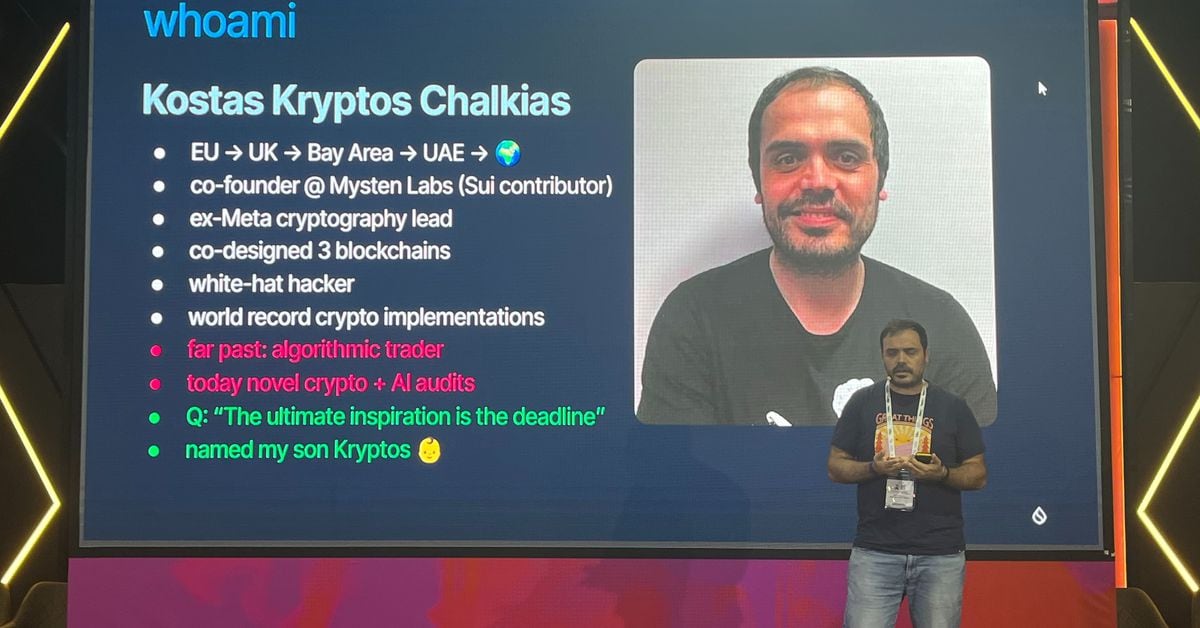

Uniswap is an example of a product in the Defi ecosystem. Defi Ecosystem aims to replace centralized intermediaries with decentralized non-custodial financial products. Hayden Adams created Uniswap.

Decentralized exchanges or DEXs are a great solution to solve many problems of centralized exchanges. Centralized exchanges have many issues, arbitrary fees, management, and the risk of hacking. However, decentralized exchanges have some issues too. Lack of liquidity or money sloshing around an exchange is one of the most critical problems of decentralized exchanges. Uniswap tries to solve the liquidity problem by swapping tokens without depending on buyers and sellers creating that liquidity.

To put it simply, one can see Uniswap as a protocol that runs on the Ethereum blockchain for swapping ERC-20 tokens. One of the most important differences, and other cryptocurrency exchanges, is that users do not have to pay fees. It is a tool to trade tokens without having to pay platform fees. Due to this innovation, Uniswap has become one of the most popular and successful products of the Defi movement.

Uniswap is an open-source automated liquidity protocol; it means there is no order book required to make trades. Using Uniswap, you can trade without intermediaries.

In this decentralized exchange, liquidity providers create a liquidity pool. In this exchange, buyers and sellers do not determine the price; Uniswap uses a decentralized pricing mechanism to smooth out the order book.

How Does Uniswap Work?

As we have said earlier, Uniswap does not use order books. It uses a model called Automated Market Maker or AMM. This model is a smart contract that acts as a liquidity pool. Liquidity providers create these pools. To use the liquidity pool, investors need to pay a fee distributed to the liquidity providers based on their pool share. Liquidity providers deposit an equivalent value of ETH or ERC20.

What Is An Automated Liquidity Protocol?

Automated liquidity protocol is how Uniswap solved the liquidity problem. The system will incentivize people to trade and become liquidity providers. The liquidity providers put their money together to create a pool. Every token there is a unique pool that liquidity providers can contribute to. In this decentralized exchange, buyers and sellers do not have to wait to complete a trade.

As there is no order book system in Uniswap, an automated market maker system will determine the price. The system determines the price according to a cryptocurrency’s increasing and decreasing price. The system considers how many coins there are in the respective pool then decides the price.

How Are Uniswap Tokens Produced?

Whenever a liquidity provider contributed to the Uniswap liquidity pool, he received a pool token. For instance, if you contribute $50,000 to a liquidity pool that holds $500,000, you will receive a token for 10% of that pool. Whenever the liquidity providers want to exist, they will receive a portion of the total fees based on their staked amount in that pool; then, the system will burn or destroy the pool tokens.

How to Use Uniswap?

The first thing to do is make sure you have an ERC20 supported wallet. Then you need to ETH to the wallet to trade on Uniswap and pay the gas. Gas is the Ethereum transaction fee. Now it’s time to head to https://app.uniswap.org or https://uniswap.exchange.

Add to connecting your wallet, log into your wallet and allow it to connect to Uniswap. Then you have to choose the token you would like to swap and enter the amount of that token. Then all you have to do is wait for the transaction to be confirmed on Ethereum the blockchain; you can also check its progress on https://etherscan.io/.

The Uniswap (UNI) Token

UNI is the governance token of the Uniswap protocol. Uniswap token holders can vote on new developments and changes to the platform. Hayden Adams created the UNI token in 2020. Everyone who has used Uniswap can claim 400 UNI tokens.