altcoins

Solana Price Analysis: Imminent $16 Correction on the Horizon?

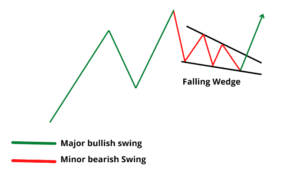

Solana (SOL) has captured the attention of investors and analysts as its price charts form a distinctive falling wedge pattern. This technical formation, often seen as a potential trend reversal indicator, has stirred discussions about the future trajectory of SOL’s value. A falling wedge pattern is a common chart pattern in technical analysis, characterized by a contracting range between two trendlines that slope in the same direction. The upper trendline, representing the declining highs, converges with the lower trendline, formed by the decreasing lows. This pattern suggests a potential bullish reversal, as the price reaches a point of consolidation, leading to an eventual breakout to the upside. Image: Bybit Learn Related Reading: Tron Reverses August Slump As TRX Open Interest Climbs Solana Vies For Bullish Upswing As SOL’s price continues to exhibit this falling wedge pattern, analysts are eyeing a potential bullish upswing in the near future. The recent retest of the lower trendline has intensified demand pressures, potentially setting the stage for a breakout. Price analysis projections point towards a potential recovery that could take SOL’s value towards the overhead trendline or even the $21.55 mark. However, the validity of this pattern relies on the integrity of the two trendlines. While the falling wedge pattern suggests a bullish outlook, a failure to maintain these trendlines could lead to further downward movement. Investors and traders remain cautious, recognizing that as long as the pattern holds, there is a risk of SOL’s value prolonging its descent and potentially reaching the $16 mark. Recent market data from CoinGecko paints a mixed picture, with SOL’s price at $20.32, reflecting a 2.8% decline over the last 24 hours and a 5.2% slump over the past seven days. These fluctuations highlight the inherent volatility in the cryptocurrency market and the impact of various factors on asset prices. Solana (SOL) is currently trading at $20.27. Chart: TradingView.com Solana’s NFT Surge Offers Glimmer Of Positivity Amidst the price struggles, the Solana ecosystem is experiencing a surge in the NFT space, offering a glimmer of positivity for the community. Recent data shared by Step Data Insights reveals that Solana has emerged as a frontrunner in NFT sales volume over the last 24 hours. NEW: Solana leads the growth of NFT Sales Volume, with nearly a 20% rise in the last 24 hours. pic.twitter.com/t1PYxHXawb — Step Data Insights (@StepDataInsight) August 24, 2023 The post highlights a remarkable 20% surge in sales volume for Solana, outperforming major competitor Ethereum (ETH), which only managed a 3.4% increase during the same period. Related Reading: PEPE Token Tumbles 20% Amid Suspicious Activity – Details While technical patterns provide insights, the volatile nature of the crypto market requires cautious optimism. Additionally, Solana’s robust performance in the NFT sector underscores its ability to diversify and adapt in the blockchain landscape. As traders and investors await confirmation of the falling wedge’s influence, the market remains poised for shifts that could shape SOL’s path in the coming days. (This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk). Featured image from CoinMarketCap